35+ How much mortgage loan can i borrow

The length by which you agree to pay back the home loan. For instance lets say the conforming limit for a 2-unit home in your area is 653550.

Business Loans Flat Concept Icon In 2022 Business Loans Loan Concept

They can either opt to receive a lump sum or receive periodic funding over an agreed number of years.

. It usually takes just one to three days and can be done online or over the phone. Different lenders have different criteria for their maximum front- and back-end ratios and other factors that consider to determine how much you qualify to borrow. VA jumbo assumes a loan amount of 548251 with no down payment.

Thats about two-thirds of what you borrowed in interest. With zero closing cost and loan fees your rate will equal your APR. They also employ stricter background checks on borrowers before approving loans.

Mortgage amount required size of the loan - Larger commercial mortgages command lower interest rates. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. _____ Current loans need to be from another financial institution and in place for at least 60 days.

Your total interest on a 1000000 mortgage. In case of joint applicants the loan can be recovered only after the death of both husband and. Small commercial mortgages will usually have a higher interest rate.

Lenders require a much higher credit score to secure a jumbo mortgage. And your loan is worth 600000 your mortgage can be sold into the secondary market as a conventional loan. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. Thats about two-thirds of what you borrowed in interest. If you take a 800000 mortgage this is considered a jumbo loan.

59 payments of 9783 with a final payment of9786. The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type of home loan that works best for your situation. The applicant can opt to receive disbursement in two ways.

A way to receive reverse mortgage proceeds in which the borrower gets access to a line of credit as well as equal monthly payments for as long as he or she lives in. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. The larger the loan then generally this may mean a lower interest rate.

Conventional jumbo loans assume a loan amount of 548251 and a 40 down payment. Qualified members can finance 80 loan to value less outstanding mortgage. Mortgage pre-qualification is an informal estimate of how much money you can borrow for a home loan.

If a house is valued at 180000 a lender would expect a 9000 deposit. The amount of money being borrowed can affect the interest rate on a commercial mortgage. Your total interest on a 250000 mortgage.

Getting creative with your loan money can also result in other problems such as increased debt. Maximum additional loan term is 25 years if any element of your mortgage is on interest only. Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term.

VA rates assume a loan amount of 250000 and no down payment. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year. A conventional mortgage or conventional loan is any type of homebuyers loan that is not offered or secured by a government entity like the Federal Housing.

Conventional Loan Terms and Payment. How Much Can You Afford to Borrow. A personal loan is repaid in monthly installments similar to a car loan or home mortgage with loan terms typically ranging from 24 months to 60 months or even longer.

Department of Agriculture Veterans Affairs and the Federal Housing Administration have very stringent criteria which may also include. 1 cash back based on loan amount refinanced. Even an auto loan can cause trouble.

They typically request at least 5 deposit based on the value of the property. Conventional Mortgages and Loans. Student loans can be especially troublesome because they are difficult to wipe out.

You can edit your loan term in months in the affordability calculators advanced options. Amounts you owed 30. In this example the lender would be willing to offer a loan amount of 171000.

If you borrow too much youll find that you owe more on the vehicle than it is worth also known as being upside down. Repayments The property remains in the possession of the applicant during their lifetime. Payment examples can be obtained by clicking the calculate payments button above and do not include taxes or insurance premiums.

You can refinance your auto loan with us from another financial institution and receive 1 cash back up to 200. In particular loan programs from the US. Amount deposited into a NEFCU Share account.

If a full internalexternal appraisal is required or requested you will be required to pay the appraisal fee which can be up to 750. Please get in touch over the phone or visit us in branch. Lenders generally prefer borrowers that offer a significant deposit.

Modified Tenure Payment Plan.

A Main Street Perspective On The Wall Street Mortgage Crisis

Borrow Loan Company Responsive Wordpress Theme Loan Company The Borrowers Mortgage Payoff

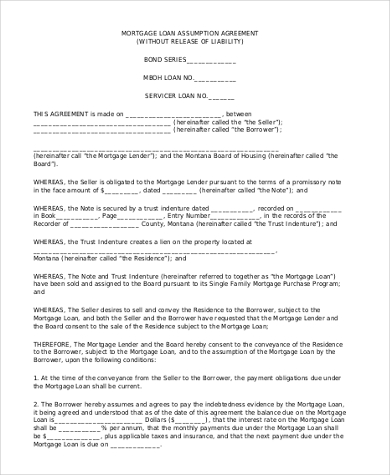

Free 7 Sample Loan Agreement Forms In Pdf Ms Word

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Mortgage Rates

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates

How Much Can I Borrow Online Mortgage Calculator Online Mortgage Mortgage Calculator Amortization Schedule

How Much Does A Mortgage Loan Officer Make Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Is It Just As Easy To Pay For A House In Cash And Then Get A Mortgage Afterwards Quora

Word Of The Day Learn English Words English Words Learn Accounting

Can I Get A House Loan Without Having A Job Quora

How Much Does A Mortgage Loan Officer Make Quora

Can I Get A Loan Against Property The Property Is In My Mother S Name Quora

Pin On Data Vis